Accessing investor databases has become a game-changer for businesses seeking funding. CapitalBridge is leading the charge with a premium service that connects entrepreneurs to 196,000 active investors ready to fund innovative ideas. With promises of 220x ROI based on previous client success, CapitalBridge could be your ultimate fundraising tool.

This review will guide you through every aspect of CapitalBridge’s offerings, helping you decide if this is the right investment for your business goals.

Table of Contents

-

- Quick Pick Section

- Comparison Table

- Detailed Review

- Pros & Cons

- Buyer’s Guide

- Things to Consider

- How We Choose

- Pro Tips

- Conclusion

Quick Pick Section

Looking for a quick recommendation? Here’s our pick for maximum impact:

- Best Value for Money: 49,000 Investors for $1,500

Affordable and perfect for businesses testing the waters. - Best ROI Potential: 196,000 Investors for $5,000

Ideal for serious fundraising campaigns aiming for exponential growth.

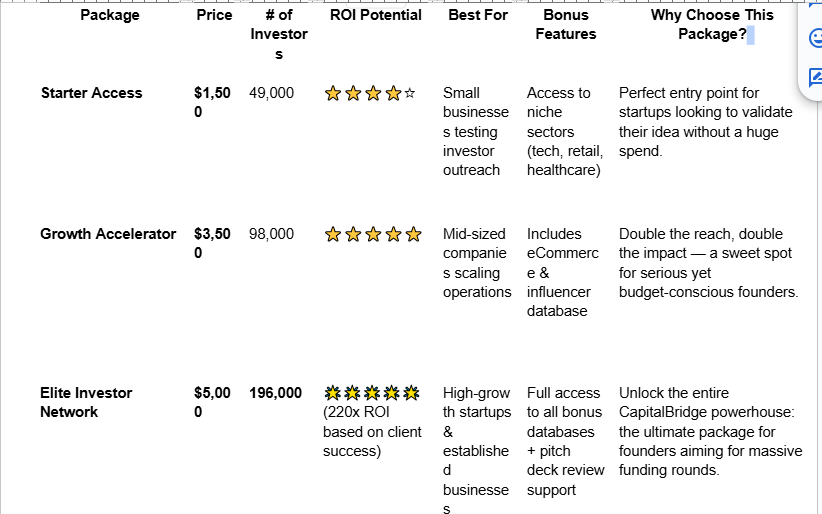

Comparison Table

Detailed Review

CapitalBridge offers access to comprehensive investor databases that allow you to connect with decision-makers directly. Here’s what makes it stand out:

1. Access to a Massive Investor Network

With over 196,000 verified investors, CapitalBridge provides unparalleled access to individuals and firms looking to fund businesses. This includes a diverse range of sectors such as tech, healthcare, and ecommerce.

2. High ROI Potential

According to previous clients, an investment of $7,500 yielded an average funding of $1,655,000, making it a 220x return on investment. Few opportunities offer this level of financial leverage.

3. Additional Resources

Higher-tier packages include databases of ecommerce businesses and influencers, adding value for companies looking to market or expand their audience.

4. Transparent Terms

CapitalBridge includes a privacy policy and terms of use, ensuring you understand the framework of the service.

Pros & Cons

Pros

- Extensive Database: Access to 196,000 verified investors.

- ROI Potential: Proven high returns for previous users.

- Scalability: Packages cater to businesses of all sizes.

- Transparency: Clear terms and conditions.

Cons

- Upfront Cost: High initial investment for premium packages.

- Learning Curve: Users must be strategic in utilizing the database for results.

Buyer’s Guide

When choosing a CapitalBridge package, consider the following factors:

- Your Business Stage: Early-stage startups may benefit from smaller packages, while established companies should consider the 196,000-investor database for maximum impact.

- Budget: Allocate a budget that aligns with your growth objectives.

- Fundraising Goals: Ensure the package matches your funding requirements.

Things to Consider

Before committing to CapitalBridge, here are some key considerations:

- Database Utilization: Having access to investors isn’t enough; you need a strategy to engage them effectively.

- Communication Skills: Create a compelling pitch that resonates with potential investors.

- Market Readiness: Ensure your business is ready for scaling or investment before approaching investors.

How We Choose

Our evaluation of CapitalBridge focused on these criteria:

- Database Size and Quality: The sheer volume and diversity of investors make this platform a standout.

- Client Testimonials: Verified success stories highlight the potential ROI.

- Value for Money: Each package is assessed for its cost-benefit ratio.

- Additional Features: Inclusion of ecommerce and influencer databases adds versatility.

Pro Tips

- Leverage the Database: Use filters to target investors aligned with your industry and goals.

- Polish Your Pitch Deck: A professional presentation can significantly boost your chances of securing funding.

- Follow Up: Consistent communication shows dedication and keeps you on an investor’s radar.

- Network Beyond Investment: Use the influencer and ecommerce databases to expand your reach.

Conclusion

CapitalBridge delivers a comprehensive solution for businesses aiming to scale or secure funding. With options ranging from $1,500 to $5,000, this service is flexible enough to accommodate businesses at various stages of growth.

Why wait? Take the leap and join hundreds of businesses reaping 220x returns on their investments. Opportunities like this don’t come often, and the chance to transform your business is just a click away.

Invest in CapitalBridge today and unlock your potential.

Investor Databases for Business Growth, High ROI Fundraising Tools for Startups, 196,000 Investors for Guaranteed Funding, Best Investor Platforms for Entrepreneurs 2024, How to Raise $1M in Funding Quickly, Affordable Investor Access for Small Businesses, Best Fundraising Databases for Startups, Ecommerce and Influencer Databases for Growth, How to Choose the Right Investor Database, Investor Networks That Deliver 220x ROI,